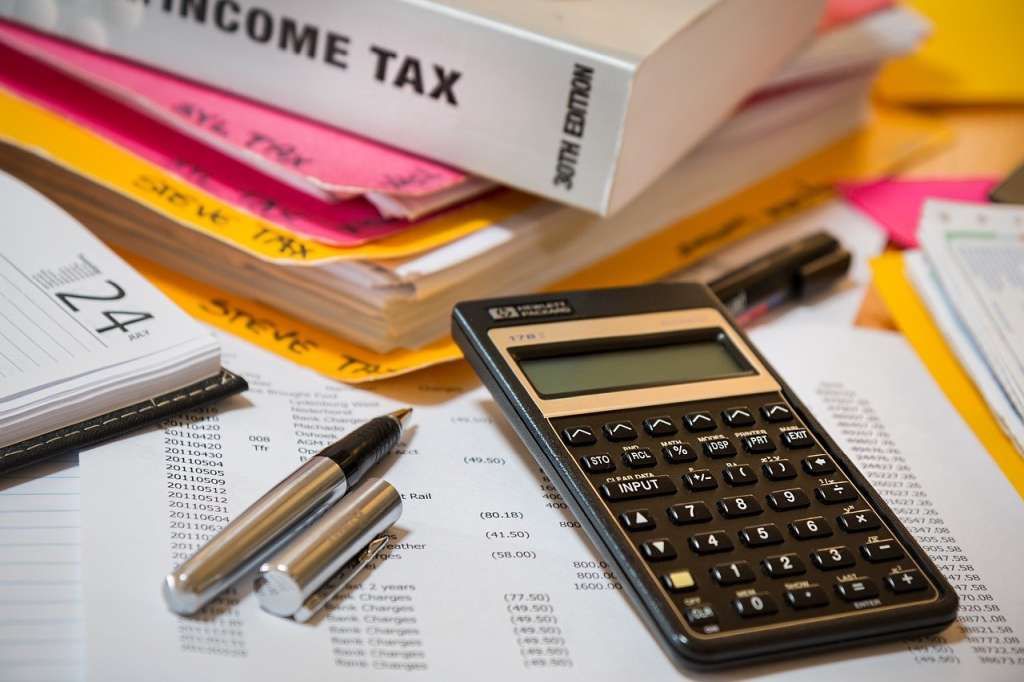

Here are a few more statute code laws on tax collecting you may want to learn regarding government. Read these laws.

Another, favorite “Organized Crime Operation” of attorneys and judges is “Tax Collection”. In this scam, the United States Attorney acts in “Fraud” to claim the private corporation “IRS” is government and fraudulently claims a debt is owed to government under Title 26 of the United States Codes.

But the “IRS” is not government or part of it, it is a private “For-Profit Corporation”. Therefore, it must be dealt with like any other “Debt Collector” under Title 15, specifically 15 USC 1692a-n, commonly referred to as the “Fair Debt Collection Act”.

Step One:

Dispute all debts in writing. By answering the claim and placing it in dispute, the IRS is required to prove its claim in court. 15 USC 1692g. (Dispute as above with questioning Federal Territorial Jurisdiction that you are a U.S. Citizen of their corporation.)

Step Two:

Challenge the IRS Agent to prove he is a government official. False or misleading statements by a “Debt Collector” is prohibited 15 USC 1692e. This establishes the crime of “Fraud” 18 USC 1001 by the IRS Agent.

Demand the Agent produce the blue-inked contract you signed with him. When he can not, no contract is present no jurisdiction for the court can be established.

Step Three:

“Validate” the debt. The IRS Agent always claims you owe this debt. So make them prove their claim. Demand the IRS Agent, to produce the physical human being who “assessed” your taxes. They have not produced one to date.

By not being able to produce the person who assessed your taxes, they can not validate the debt because it can not be proven correct or incorrect by cross-examination. Demand a dismissal WITH PREJUDICE of all claims.

Step Four:

If a debt can not be validated, there can be no collection of it. This is established by 15 USC 1692g(b). Disputed Debts a debt collector must cease collection of the debt until it is validated.

Step Five:

Challenge attorney for “Agency” with IRS as outlined above.

Step Six:

Challenge Judge and Bank for “TERRITORIAL jurisdiction” without a lawful claim as outlined above.

Think about it.

Related Articles:

Pay with PayPal or Your Credit Card below..

Note:Sometimes PayPal experiances Techinical Issues, If this is the case, Please try again later.-

Ebook Bundles

CAP Security + PBNBA Private Banker E-books $45.00

Original price was: $70.00.$45.00Current price is: $45.00. Add to cart -

Ebooks

CAP Financial Security Instrument E-booklet $29.95

Original price was: $60.00.$29.95Current price is: $29.95. Add to cart -

Ebooks

PBNBA Private Banker E-booklet $29.95

Original price was: $60.00.$29.95Current price is: $29.95. Add to cart -

Ebooks

Strawman Termination E-booklet $29.95

Original price was: $60.00.$29.95Current price is: $29.95. Add to cart -

Ebooks

Simple Trick on How to Get Negative Credit OFF your Credit Bureau Credit Reports And Raise your Credit Scores to over 750 DIY E-booklet $25.00

Original price was: $50.00.$25.00Current price is: $25.00. Add to cart -

Ebooks

HOW TO Receive 800+ Credit Scores After Negative Credit Is Erased DIY E-booklet $25.00

Original price was: $50.00.$25.00Current price is: $25.00. Add to cart -

Ebooks

How To Buy a HOME with JUST a Down Payment by Legally Changing the Contract for a Meeting of the Minds DIY E-booklet $1,000.00

Original price was: $2,000.00.$1,000.00Current price is: $1,000.00. Add to cart -

Ebooks

How To AVOID Paying Property Taxes On Your New Down Payment Home Purchase by filing Bill of Sale and Deed DIY E-booklet $1,000.00

Original price was: $2,000.00.$1,000.00Current price is: $1,000.00. Add to cart -

Ebook Bundles

Simple Trick on How to Get Negative Credit OFF your Credit Bureau Credit Reports and Raise your Credit Scores to over 750 DIY E-booklet + HOW TO Receive 800+ Credit Scores DIY E-booklet + How to Establish Good Credit when you have none DIY E-booklet $60.00

Original price was: $75.00.$60.00Current price is: $60.00. Add to cart -

Ebooks

How To Establish Good Credit When You Have None DIY E-Booklet $25.00

Original price was: $50.00.$25.00Current price is: $25.00. Add to cart -

Ebooks

How To Foreclose on Your Bank and Receive Up To 3 Times the Amount of Your Mortgage DIY E-booklet $1,000.00

Original price was: $2,000.00.$1,000.00Current price is: $1,000.00. Add to cart -

Ebooks

True Affidavit That Helps Win All Court Cases DIY E-booklet $397.00

Original price was: $2,000.00.$397.00Current price is: $397.00. Add to cart -

Ebooks

3 for 1 price. WHAT To Do In Your Foreclosure COURT Case To Win Against BANKS PLUS (+) True Affidavit Court Case Win PLUS (+) Plus Questions of Presumption to be answered (BONUS DIY E-booklet) $1,300.00

Original price was: $2,000.00.$1,300.00Current price is: $1,300.00. Add to cart -

Ebook Bundles

Legally Travel Without Worries of Receiving Speeding Tickets DIY E-booklet + Strawman E-booklet $397.00

Original price was: $529.95.$397.00Current price is: $397.00. Add to cart -

Ebooks

Legally Travel Without Worries of Receiving Speeding Tickets DIY E-booklet $419.00

Original price was: $1,000.00.$419.00Current price is: $419.00. Add to cart -

Ebooks

How To List Any Real Estate Property For 8% to 12% Sales Commission DIY E-Booklet $700.00

Original price was: $2,000.00.$700.00Current price is: $700.00. Add to cart -

Ebooks

How To Perfect Allodial Title Of Property Through Land Patent In Any STATE Step by Step DIY E-booklet $595.00

Original price was: $2,000.00.$595.00Current price is: $595.00. Add to cart -

Ebooks

WHAT To Do In Your Foreclosure COURT Case To Win Against BANKS DIY E-booklet $429.00

Original price was: $2,000.00.$429.00Current price is: $429.00. Add to cart -

Ebooks

How To Foreclose on Your Bank and Receive Up To 3 Times the Amount of Your Mortgage DIY E-booklet $1,000.00

Original price was: $2,000.00.$1,000.00Current price is: $1,000.00. Add to cart -

Ebook Bundles

How To Foreclose on Your Bank and Receive Up To 3 Times the Amount of Your Mortgage DIY E-booklet + How To List Any Real Estate Property For 8% to 12% Sales Commission DIY E-Booklet $1,600.00

Original price was: $2,000.00.$1,600.00Current price is: $1,600.00. Add to cart -

Ebook Bundles

How To Buy a HOME with a Down Payment by Legally Changing the Contract for a Meeting of the Minds + Avoid Property Taxes With New Home Purchase By Filing a Seller DEED and a Seller Bill of Sale DIY E-Booklet $1,700.00

Original price was: $2,000.00.$1,700.00Current price is: $1,700.00. Add to cart